Global capitalism heading to an epoch of crisis, war, and revolution once again

- Joonseok

- 등록 2023.02.05 21:25

- 조회수 474

The war in Ukraine and record-breaking inflation, these two events representing the world in 2022, represent that global capitalism is finally entering a new epoch. While by what name the new epoch will be called has not yet been known, its character is obvious. It is the epoch that the whole world will be covered with crises and wars, and so will have to be covered with revolution.

For the last 30 or so years, what makes global capitalism maintain 'relative stability and peace' has been so-called 'globalization' and 'financialization,' combined with neoliberalism. But as globalization no more gets to function properly due to its inherent contradiction and financialization has accumulated its inherent contradiction too enormously, global capitalism is entering into a new epoch filled with a series of severe fractures and ruptures. This change that had been proceeding in a not-well-visible way finally began to unfold in a shocking way anyone could notice through the war in Ukraine and record-breaking inflation.

The war in Ukraine

As everyone knows, the war in Ukraine broke out as tensions and conflicts between the US-Europe imperialist camp and Russian imperialism finally blasted. But, in its background, the full-grown US-China supremacy confrontation was laid that globalization inevitably has induced. In the background that the US-Europe camp had been upgrading the level of geopolitical encompass endlessly to provoke Russia until the war erupted, there was today's world dominance strategy of the US intending to complement weakened economic supremacy by strengthening military supremacy. The basis that made Russia take the risk of invasion of Ukraine would have been the result of strategic judgment that now Russia also could come forward to enlarge its influence actively because the supremacy of the US is weakening with the rise of China.

The war in Ukraine has shown that the confrontation between imperialist powers with the US and China at its peak is now starting to reach even military conflicts through proxy wars and local wars. The war in Ukraine has made the possibility a matter of hot concern worldwide that the US and China would engage in a direct military confrontation over Taiwan in the not-so-distant future. Given that the destined supremacy confrontation between the US and China continues in the future, the danger for the US and China to engage in military conflict over Taiwan will gradually increase. The danger of the Korean Peninsula to be fell into a place for another imperialist proxy war will also be the case.

Record-breaking inflation

The recorded inflation of around 10% in the US and Europe and several tens% in numerous third world countries are the first things in 40 more years since the stagflation swept away the 1970s. While there are various opinions on the cause of inflation, we can point out the rise of the real value of commodities due to the increase in the supply price, the rise of the nominal price of commodities due to the decrease in money value, and the rise of the prices of energy and foods brought about by the war in Ukraine and climate crisis as the causes.

In the early stage of this inflation, 'the increase in the supply price' looked to happen due to the disturbance of supply chains mainly caused by the COVID-19 pandemic lockdown. But as time has passed, other factors that are even much more structural have been pointed out. On the one hand, it is pointed out that as the 'inverse-globalization' current that goes against globalization has accumulated, the advantage of 'supply at the lowest unit price' brought by globalization has begun to diminish noticeably. On the other hand, it is pointed out that this is the result of having avoided industrial investment in even essential materials for the reason of low profitability, as the tendency to depend on financialization in coping with the decline in profit rate overall capitalist system has intensified. These two aspects suggest that this inflation was triggered by the results that globalization no more gets to function properly and financialization has made severe side effects.

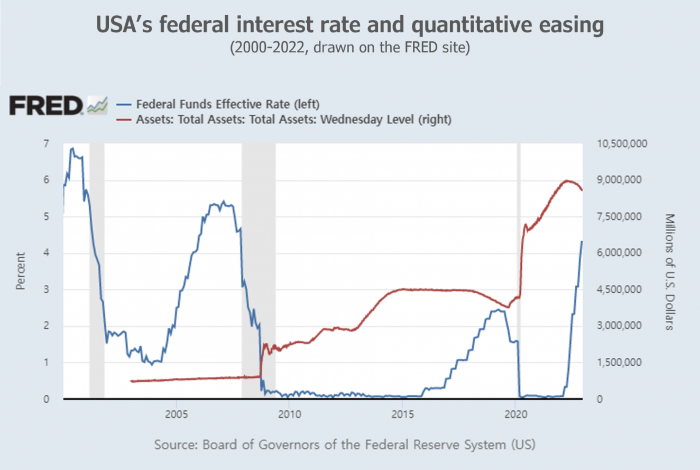

It is pretty contentious whether 'the decrease in money value' due to the expansion of the money supply also is the cause of this inflation. Especially the fact that there was no inflation after 2008, even though the US, Europe, and Japan carried out long-term quantitative easing for more than ten years, is presented as the principal basis for the objection. The hyperthesis that, even though too much money is supplied, money that is not necessary for commodity circulation is hoarded without being used and does not affect the price level is also presented. But when we look into history, we can find several cases where the expansion of the money supply was a key factor in inflation. Cases that led to hyperinflation were typical. Also, we need to recall that, in the 1970s' world-sweeping inflation, not only the oil shock but also the decrease in the dollar value as a key currency acted as leading causes. The decrease in the dollar value had been brought about as the US had over-supplied the dollar to cope with the Vietnam War, and then its effect had been amplified as the gold convertible system had been abolished. While it can't be said that the expansion of the money supply always (and in proportion to expanded quantity) causes inflation, it would be a more rational hypothesis that when the money supply exceeds a certain 'critical point,' it could decrease the money value by increasing the quantity of money actually used in commodity circulation and cause inflation. The facts below can be suggested as the factors that made the 'critical point' be exceeded; 1) Tremendous amount of money, more than the total of quantitative easing over the past ten years, was rapidly injected to cope with the COVID-19 crisis after 2020. 2) Different from the past when the effect of quantitative easing was focused on the asset markets such as stocks and real estate by supplying money into the bond market, after 2020, considerable money was paid to ordinary people and directly injected into commodity circulation. 3) The resistance force that deters the start of inflation was weakened because factors on the supply side also acted together.

'The rise of the prices of energy and foods' caused by the war in Ukraine and the climate crisis seems to will find its place when the war in Ukraine is over, and the production of grains in particular regions hit by the climate crisis is recovered. But what if the war in Ukraine is not easily over? What if another war breaks out in other strategic regions? What if the production of grains is disrupted in more and more regions each year due to the increasingly deteriorated climate crisis? 'The rise of the prices of energy and foods' may not be a simple temporary factor.

Structural inflation and the direction of global capitalism

If now-unfolding inflation is caused by structural factors in many parts, this inflation will inevitably continue for some time. At this moment, central banks around the world, including the US Fed, have been aggressively raising interest rates. This may ease inflation to some extent. But, if the policies are loosened, inflation will likely surge again like an extinguished fire comes to revive.

Inflation inflicts considerable pain on workers and people by reducing purchasing power. Persistent inflation pushes workers and people so that they have no choice but to fight for survival constantly. This is why inflation has to be a severe headache for the ruling class as well. However, persistent inflation will also have a crucial meaning for the future direction of the overall capitalist global economy.

As will be explained in detail later, ultra-low interest rates and quantitative easing, which have been like a savior for global capitalism since 2008, can work effectively only on the premise that inflation does not occur. So the fact that inflation will inevitably continue for some time indicates that there will be significant changes in the unfolding features of the capitalist economy.

Since 2008, the bubble of asset markets such as stocks and real estate has been a key instrument of offsetting the decline in profit rate overall capitalist system. Banks, the backbone of the capitalist economy, have gained more earnings from loans related to real estate and stock investments than industrial investments. The prices in asset markets, divorced from the real economy, rightfully have shown rapid decline signs periodically. But each time, interest rate lowering and quantitative easing have boosted the asset bubble again, playing a role of a solution.

But now, central banks worldwide have been raising interest rates rapidly to control inflation, increasing the burden of repayment of debts of households, corporations, and governments accumulated on an unprecedented scale. And this, in turn, leads to a decrease in real estate and stock prices and a credit crunch in the bond market. What if central banks worldwide stick to interest rate raising to make this situation continue for some time? On the one hand, many household bankruptcies will happen with big plunges in real estate and stock prices. On the other hand, many corporation bankruptcies will happen with the widespread failures to extend debt maturities. And they will lead to explosive increases in bad loans, which will lead to bankruptcies of financial institutions, furthermore, a financial crisis.

Therefore, central banks worldwide won't be able to continue raising interest rates. When there is a sign that inflation subsides even to some degree, they will not only hurry to stop raising interest rates but also carry out interest rate lowering and quantitative easing again, pursuing asset price escalation and debt enlargement. This is because only then will today's capitalist global economy, which is barely surviving by depending on financialization, be able to avoid sinking and continue to operate. The problem is, in that situation, whether inflation will subside quietly. What if various structural factors that caused this inflation remain still unresolved? It looks highly likely to do so. Then, interest rate lowering and quantitative easing by central banks worldwide will provide enormous energy to inflation, playing a role in provoking inflation to crazily hop around.

If then, central banks worldwide will have to turn to interest rate raising to control inflation again, which will escalate the danger of a bubble bursting in asset markets and a financial crisis occurring. So it won't be long before they turn again to interest rate lowering and quantitative easing to avoid a bubble bursting and a financial crisis. But this time, inflation will be more rampant. Even if a catastrophic situation can be luckily avoided once or twice, as this vicious cycle continues, the explosiveness of a financial crisis and the wave height of inflation will become increasingly higher. After all, it looks very likely that global capitalism is heading to either a great financial depression or hyperinflation, or even both of them.

Bourgeois economic analysts' views

The fact that capitalism has entered a new epoch and that the global economy is likely to run into a catastrophic situation is expressed, to some extent, even in some bourgeois economic analysts' views.

(Omission)

The epoch of crisis, war, and revolution

World war I broke out in 1914 as the result of more fierce concentration on a scramble for colonies by imperialist powers competing for supremacy, such as the UK, France, Germany, etc., to overcome economic damages after the severe global economic crisis in the early 1900s. World war II started in 1939 as the result of finally finding a solution to the Great Depression unsolved over ten years by imperialist powers competing for supremacy, such as the US, the UK, Germany, Japan, etc., in massive military spending expansion, the war economy, and even mass destruction and genocide.

If the capitalist global economy increasingly approaches toward great financial depression and hyperinflation in the near future, this will more rapidly increase the intensity of conflicts between imperialist powers already reaching the stage of proxy wars and local wars. At this moment, we cannot predict the concrete features of the future. But it is clear that the upcoming epoch will inevitably be an epoch marked by crises and wars. In an epoch full of bankruptcies, unemployment, poverties, and wars, even to which climate disasters add, the working class worldwide will have no choice but to rise up with strikes, revolts, and revolutions, even for survival.

This article is to explain overall backgrounds to help a more accurate understanding of the nature and meaning of the new epoch that can be summarized like above. For this, for example, answers to some following questions will be tried to suggest. If a transition to the new epoch is taking place now, what epochs have there been in the history of global capitalism? What are the factors that make epochs distinguished from each other in capitalism? How did the epoch of neoliberalism, globalization, and financialization that dominated global capitalism over the past forty years emerge? What inherent contradictions have operated, leading that epoch to end up? Finally, what is the position and implication of the new epoch in the history of global capitalism?

<1> Factors that make epochs distinguished in the history of capitalism

From its beginnings until now, capitalism has invariably been based on the endless exploitation of the working class. In addition, to divide the working class and sustain the exploitation system, it has continued oppression and discrimination against women, LGBTQ+, blacks and people of color, immigrants, disabled, etc. Furthermore, by absolutizing only the blind extended reproduction of capital, it has destroyed essential environments for human survival, such as the coexistence between nature and humanity or the harmony between urban and rural areas, to an irrecoverable degree.

But capitalism has not always shown the same features. Just like a person has gone through the stages of childhood, youth, maturity, and old age throughout a lifetime, capitalism has also passed through several epochs that have been considerably distinguished from each other in the relation between capitals, the relation between capitals and states, the relation between states, the mode of combination between exploitation and expropriation, and the level of class struggle.

It can be said that capitalism has passed largely through five epochs until now. The first is 'the epoch of free competition and bourgeois revolution' from 1776 to 1871. The second is 'the epoch of monopoly and full-scale imperialism' from 1871 to 1914. The third is 'the epoch of world wars, Great Depression, and workers' revolution' from 1914 to 1945. The fourth is 'the epoch of postwar boom and reformism' from 1945 to 1980. And the fifth is 'the epoch of neoliberalism, globalization, and financialization' from 1980 to recent days.

(1) Long-term realization of the tendency of the rate of profit to fall

(Omission)

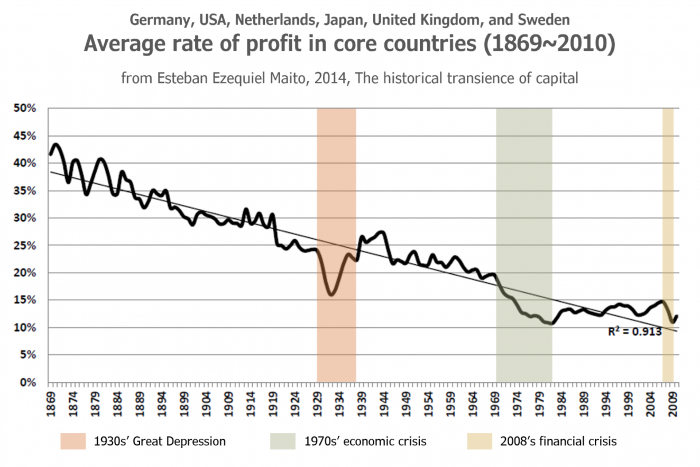

Then, in the real history of capitalism, how has the tendency of the rate of profit to fall been realized? In this regard, An Argentinean, Esteban Ezequiel Maito, published a meaningful study result in 2014. It is an actual calculation of the average rate of profit in six core countries, including the US, the UK, Germany, Japan, Sweden, and the Netherlands, from 1869 to 2010. The study result says that the rate of profit started above 40% around 1870, repeated to tendentially decline, and then reached 10-15% these days.

(Omission)

(2) Desperate policies to offset the tendency of the rate of profit to fall

(Omission)

The core policy that capitalist states pursue to offset the decline in profit rate has differed in each period. For example, from 1871 to 1914, capitalist states' key policy to offset the decline in profit rate was 'capital export to colonies,' and from 1914 to 1945, it was 'wars.' From 1945 to 1980, it was 'expansion of effective demand,' and from 1980 to recent years, it was 'neoliberalism, globalization, and financialization.' The core policies have had to be changed in each period because, after some time passed, due to accumulated contradictions, they didn't correctly act anymore, or the counter-effectiveness became very severe.

(Omission)

(3) The degree of deepening in the capitalist crisis

(Omission)

The accumulation of contradictions has not been confined to the economic aspects. Contradiction has also accumulated in social, political, and international aspects. The explosion of contradictions in those areas has also aroused decisive crises in the old accumulation system or capitalism itself. For example, 'capital export to colonies', the core policy to offset the decline in profit rate from 1871 to 1914, raised the conflicts between imperialist powers around the repartition of colonies, finally bringing about World War I from 1914 to 1918. And the economic contradiction accumulated in that period finally burst into the Great Depression worldwide from 1929 to 1939, and social, political, and international contradictions aroused by the Great Depression burst into World War II from 1939 to 1945.

These show the big picture of capitalism's history. In the early phase, there is a period of growth with vigor. Then a period of contradiction accumulation with ostensible peace and stability follows. And then, when reaching a certain point, a period unfolds when, as accumulated contradictions explode, everything fiercely turbulences and collides with each other and so capitalism itself is decisively at stake.

(Omission)

(4) The mode of combination between exploitation and expropriation

In the Marxist tradition, 'exploitation' means stealing surplus value created by workers within the capitalist production process. Whereas 'expropriation' means robbing or thieving someone's property outside the surplus value production process.

The center of the capitalist production process is in organizing social production and, through that, exploiting surplus value. Enormously developed social production makes surplus value as enormous as its size. So the center of profits reaped by capitalists is based on exploitation. But the tendency of the rate of profit to fall makes capitalists endlessly crave additional profits based on expropriation to offset the tendency.

(Omission)

The mode of combination between exploitation and expropriation has repeatedly changed. When capitalists were able to earn profits smoothly, they relatively concentrated on exploiting surplus value. But when suffering from the decline in profit rate, capitalists more actively combined expropriation outside the surplus value production process to supplement reduced profits (or to offset a further decline in profit rate). The focussing point of expropriation has also changed. For example, while total plunder of colonies was at the center until the early 20th century, these days, financial expropriation is at the center.

(Omission)

(5) The degree of maturity in the revolutionary capability of the working class

(Omission)

The unity and class consciousness of the working class, and the extent of how mature its revolutionary capability is, affect the range and intensity of policies used by states to offset the decline in profit rate. More importantly, they decisively affect whether capitalism, in which contradictions finally explode, can revive with a young body and open another epoch by shaking off its contradictions considerably through harshly sacrificing workers and people.

(Omission)

The epoch of crisis and war bears the epoch of revolution. It is because horrible catastrophes of wars and great depression provide the urgent necessity and possibility for the workers' revolution. But the workers' revolution does not come true by itself. Only by building the revolutionary capability of the working class can we prevent capitalism, which has already fulfilled its historical vocation, from extending its lifespan at the expense of the working class and humanity through horrific barbarism.

<2> Four epochs before the epoch of neoliberalism, globalization, and financialization

How did 'the epoch of neoliberalism, globalization, and financialization' emerge? What inherent contradictions have made it end? What position and implication does the new upcoming epoch have in the whole history of capitalism? To answer these questions, we need to understand previous epochs. So let's briefly check the characteristics of the four epochs before the epoch of neoliberalism, globalization, and financialization around the contents necessary for understanding today's epochs.

(1) The epoch of free competition and bourgeois revolution (1776-1871)

(Omission)

(2) The epoch of monopoly and full-scale imperialism (1871-1914)

(Omission)

(3) The epoch of world wars, Great Depression, and workers' revolution (1914-1945)

(Omission)

(4) The epoch of postwar boom and reformism (1945-1980)

(Omission)

<3> The end of the epoch of neoliberalism, globalization, and financialization

As passing through the economic crisis of the 1970s, the profit rate in the overall capitalist system very severely declined, dropping to the ground. The capitalist class, which had repressed the worldwide uprising of the working class in the 1970s, has very aggressively pursued special measures to not only offset the decline in profit rate but even to raise it again since the 1980s. A set of measures that combine neoliberalism, globalization, and financialization dominated the world over the past 40 years.

(1) Neoliberalism, globalization, and financialization that swept away the world since the 1980s

Neoliberalism was the first measure that capitalist states pursued to offset the tendency of the rate of profit to fall and even raise the dropped-to-the-ground profit rate again. Neoliberalism, which encompasses specific policies such as mass layoffs, wage cuts, irregularization of the labor force, social welfare cuts, neutralization of labor unions, tax cuts for capitalists, deregulations, privatization of key industries, etc., to cut a long story short, puts its aim in strengthening the exploitation of workers as much as possible and giving all kinds of benefits to capitalists, artificially raising the profit rate of capital.

Neoliberalism, which was through the experiment by Chile's military regime in the mid to late 1970s and inaugurated by conservative governments in the UK and the US in the 1980s at full scale, dispersed to the whole world throughout the 1990s. This especially accompanied the process that social democrat governments became the executors of neoliberal policies in many countries. In those cases, they often utilized the method that 'democratically' promoted neoliberalism based on labor-management-government negotiation.

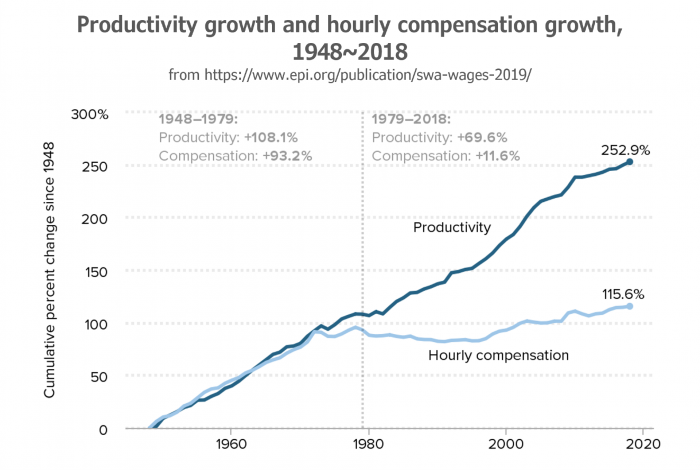

The result of neoliberal policies that forcibly decline the working and living standards of workers and artificially raise the profit rate of capital has been prominently represented, especially in the US. From 1979 to 2018, while the productivity growth in the US was 69.6%, hourly compensation growth was only 11.6%. In 2007, the real wage of the workers in the US was just 85% of that in 1974.

Therefore, neoliberalism was considerably effective in the recovery of the profit rate but soon reached its limit. It was because of the contradiction that was inherent in neoliberalism itself. The more each corporation recovered its profit rate thanks to neoliberalism policies, the poorer workers became, and the bigger the gap between production and consumption in the whole society became. Overproduction that became increasingly serious led to structural sale slumps and made significant barriers to the recovery of profit rates.

Additional measures were needed to complement the decisive limit of neoliberalism. So globalization and financialization were added.

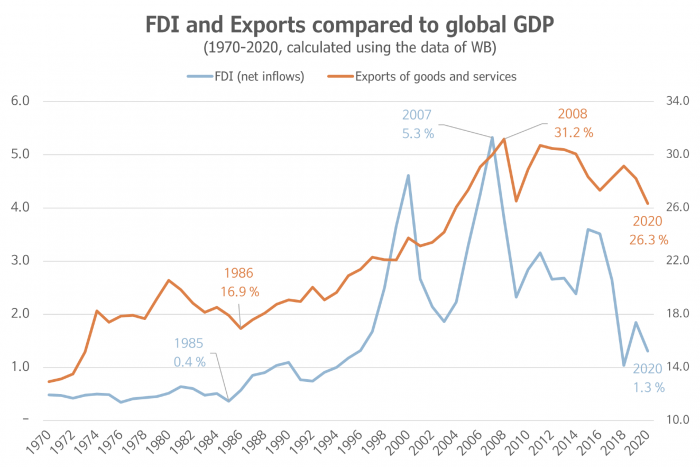

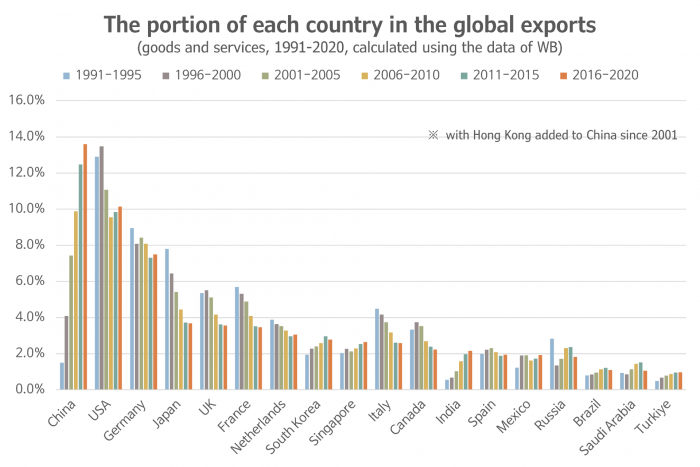

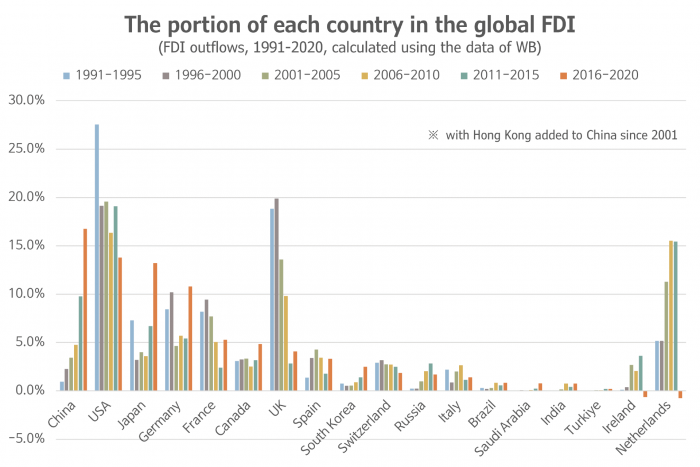

Globalization, which combines 'globalization of production' and 'globalization of markets,' accelerated from the mid-1980s and started to unfold in all aspects with the launch of WTO in 1995. Global FDI inflow to global GDP increased from 0.4% in 1985 to 5.3% in 2007. Global exports of goods and services to global GDP increased from 16.9% in 1986 to 31.2% in 2008. In particular, the transition to a market economy in China in the 1980s and the collapse of East European countries and the USSR in 1989-91 destroyed the Stalinist camp, contributing largely to integrating the world into a single supply chain and single market.

The 'globalization of production,' which moved all or part of the production bases across borders to all corners of the world in search of cheap and submissive workers, contributed greatly to raising the profit rate of capital. Factory relocations to underdeveloped countries drastically decreased wage costs to the extent of even more than offsetting additional logistics costs. Threats of factory relocations became the most potent weapon of capitalists in developed countries to neutralize labor unions and compel them to retreat.

'Globalization of markets,' which integrated the world into a single market by breaking the trade barrier between countries, complemented the weakness of neoliberalism that increasingly enlarged the gap between production and consumption by dramatically expanding markets. Cheap imports, represented by Chinese products, made the workers in developed countries get by based on decreased wages, effectively blocking the wage decrease from leading to workers' struggles.

Factory relocation worldwide largely changed the landscape of capitalism. Factories, which concentrated in the US, Western Europe, and Japan, moved toward Latin America, Eastern Europe, and East Asia and then rushed into China as their final destination. Global capitalism reorganized itself around two axes China's production and the US's consumption.

Financial capital is originally capital that reaps earnings by receiving part of the surplus value acquired by industrial capital in the form of interests or dividends through loans or stock investments for industrial capital. While financial capital doesn't directly participate in surplus value production, it indirectly contributes to the surplus value production of industrial capital by collecting idle money in society and providing it to industrial capital. So interests or dividends are distributed to financial capital in return.

However, if stock prices continue to sharply rise up, financial capital can earn even much more returns through the margin between the purchase and sale of stocks than interests or dividends. If even the middle class and the upper layer of the working class are attracted to participate in stock markets by arousing the illusion of speculative unearned income, stock prices must naturally rise for a while. Financial capital can reap additional earnings also through high-interest loans to stock market participants. Rightfully, stock prices that distant far from their real value must inevitably plunge someday. But, usually, big owners already realize margins before the plunge, and most of the losses due to the plunge are passed to small investors.

Such financial expropriation can be used as a way to offset the tendency of the rate of profit to fall, but it has very large side effects. It is because when stock prices plummet, numerous people go bankrupt and, by the shock, even banks, leading to the overall economy immersing into a very tough situation. This was the case when the Great Depression began in the US in October 1929.

When coping with the Great Depression in the 1930s, the US introduced various regulations on financial institutions like banks. The most important was the prohibition of concurrent business of commercial and investment banks, which prevented commercial banks handling deposits from participating in high-risk areas like stock investments. Such regulations, introduced to hinder the recurrence of something similar to the Great Depression, continued for more than 60 years until the late 1990s. However, the US broke up such regulations on a large scale in 1999. Representatively, the prohibition of concurrent business of commercial banks, insurance firms, and investment banks was abolished. It meant to open the way for inducing even small money owned by the masses into speculative and high-risk areas as much as possible.

Like this, the process in which financial expropriation unfolds briskly under the active support of states is just financialization. Financialization, which became at full scale in the late 1990s, has been a device to supplement additional earnings by financial expropriation for capitalists who could not reap sufficient profits only with exploitation through surplus value production due to bottom-crawling profit rates in the overall capitalist system.

Financial expropriation has not been confined to stock trades. Trades of corporations themselves to acquire corporations, raise 'values' through massive restructurings, and sell them again have also been an important area of financial expropriation. In the real estate market, something similar to the stock market has happened on a much larger scale. In this market, the size of mortgage loans is overwhelming, so financial institutions' earnings through them have been even more significant. In addition, the earnings from rising rents due to surging housing prices also have been considerable. As financialization expands, areas of financial expropriation have endlessly spread to the foreign exchange market, raw material market, futures market, and recently the cryptocurrency market.

Financialization greatly expanded the financial sector. In 2006, while the global GDP was $51.8 trillion, the sum of stock markets and bond markets in the world was $119 trillion. In 2007, the money managed by hedge funds, which could be called the vanguard of financialization, was $10.1 trillion. In the UK, In 2007, while manufacturing industries employed 3 million, the financial sector employed 6.5 million. In the US, total financial institutions' assets to GDP soared from 110.3% in 1985 to 224.2% in 2007. In the US, as a result of combining globalization and financialization, while the share of manufacturing industries in GDP reduced from 25.6% in 1947 to 11.2% in 2009, the share of the sum of finance, insurance, real estate, and rental & leasing in GDP grew from 10.5% in 1947 to 21.5% in 2009.

(Omission)

(2) The 2008 financial crisis and the Great Recession

(Omission)

The 2008 financial crisis was the biggest event after the Great Depression in the 1930s in the history of capitalism. With the risk of going bankrupt of major financial institutions in the US and even other countries in a row, global capitalism was on the verge of paralysis. Financial expropriation through the surge in real estate prices and predatory loans, which made 2 million households homeless, gave enormous earnings to capitalists. But it came back as a boomerang and pushed the capitalists' ruling system itself to just before catastrophe.

Faced with the danger of the entire capitalist system's collapse, the capitalist class, which had been crying out neoliberalism and arguing 'leave it all to the market,' shamelessly provided astronomical bail-out money to financial institutions through states. According to a report by the Bank of England in November 2009, the bail-out money poured by the US, the UK, and Eurozone amounted to $14 trillion, accounting for one-fourth of global GDP in 2009.

Banks were barely prevented from bankruptcies, but consumer markets in developed countries rapidly shrank. In just three months after the break out of the financial crisis, global production and trade were reduced by more than 30%. In particular, in China, 20 million jobs disappeared around export industries in only three months just after the financial crisis. This time, for an economic boost, governments around the world poured tremendous finance. While developed countries around the US promoted consumption mainly using subsidies and tax benefits, emerging countries around China mobilized massive civil engineering and construction projects. For two years after the financial crisis, finance poured by governments worldwide to stimulate economies was estimated to surpass $5 trillion.

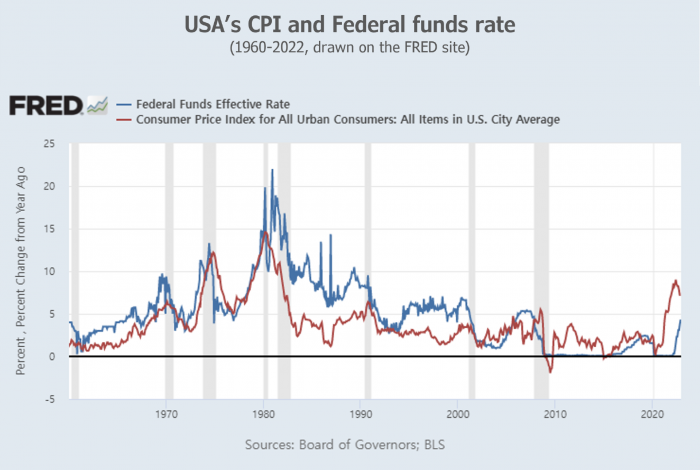

Meanwhile, central banks in major countries such as the US, Europe, and Japan implemented massive quantitative easing and ultra-low interest rates policies for a long time to boost economies. For example, the US Fed carried out three times of quantitative easing, a policy in which the central bank expands the money supply by purchasing bonds held by banks, on a scale of $3.6 trillion over six years from November 2008 to October 2014. And Federal Reserve maintained its standard interest rate, Federal Funds Rate, at zero (0.00~0.25%) over seven years from December 2008 to December 2015.

Like these, by mobilizing unprecedented tremendous bail-outs and stimulation policies, capitalist states could prevent the 2008 financial crisis from developing into another great explosive depression, which is full of massive bankruptcies and unemployment like the Great Depression in the 1930s.

But the Great Recession was unavoidable. According to the World Bank, the average growth rate of the world economy for 12 years from 2008 to 2019 was recorded at only 2.5%. This was much lower than the average growth rate from 1995 to 2007 at 3.4%, let alone the rate from 1961 to 2007 at 3.7%. Moreover, this figure was the result barely achieved by mobilizing for a long time astronomical fiscal expansion and unprecedented ultra-low interest rates and quantitative easing for states worldwide to boost economies.

In some parts, the period of the Great Recession showed remarkable growth and aggressive investments among big-tech corporations like Apple, platform corporations like Amazon, and so-called 'green' corporations like Tesla. However, in overall aspects, the period showed extreme investment avoidance phenomenon due to profit rates' inescapability from bottom-crawling in the overall capitalist system.

One representative example that showed the investment avoidance phenomenon in the overall capitalist system was the expansion of 'share repurchase' in the US. Based on the Trump administration's policy that gave tax cut benefits to corporations retrieving their foreign investment back to the US, in the first quarter of 2018, US corporations retrieved $217 billion to the US, accounting for about 10% of total foreign investment money which is $2.1 trillion. However, only $2 billion was expensed on productive investment among $81 billion that the upper 15 corporations retrieved. Whereas, in the second quarter of 2018, the amount of share repurchasing by US corporations reached $150 billion which increased three times compared to the first quarter. That is, the most of foreign investments retrieved to the US were used in share repurchasing, which is for management right defending or stock price raising, instead of productive investment.

The investment avoidance phenomenon largely affected also the direction of loans by banks. While commercial and industrial loans accounted for 25.0% of total credit provided by US commercial banks from 1970 to 1981, but only 16.1% from 2008 to 2019. Whereas, the portion of real estate loans increased from 19.1% to 37.0% between the same periods.

(Omission)

After all, the period of the Great Recession was not a process of going ahead toward a new boom by resolving contradictions that were generated in the capitalist accumulation system, but a process of going ahead toward a large-scale explosion by more accumulating and deteriorating contradictions. The accumulation and deterioration of contradictions unfolded in both aspects of globalization and financialization.

(3) Reshoring, protectionism, and supremacy confrontation brought about by globalization

Globalization was a very effective instrument in offsetting the tendency of the rate of profit to fall and even recover profit rates by making it possible for capitalists to force low wages both in developed and emerging countries. And it also functioned to block low wages from leading to workers' struggles by maintaining low prices.

However, globalization, especially the 'globalization of production,' largely retreated through the Great Recession. Global FDI (net inflows) compared to global GDP, which started at 0.4% in 1985, reached 5.3% in 2007 as a result of a tendential rise, but then recorded 1.3% in 2020 as a result of a tendential decline. Global exports of goods and services compared to global GDP, which started at 16.9% in 1986, rose to 31.2% in 2008, but then tendentially declined, recording 26.3% in 2020.

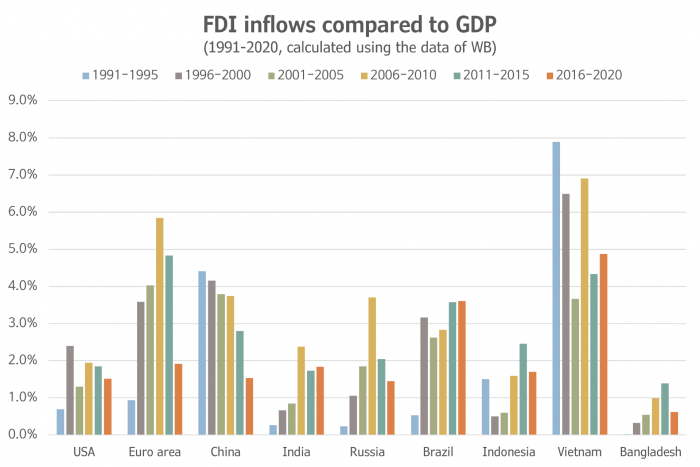

In large part, the ratio of FDI inflows compared to GDP in main countries and regions saw its figure decline in 2016-20 than 2006-10. Specifically, the figure declined from 1.9% to 1.5% in the US, from 5.8% to 1.9% in Eurozone, from 3.7% to 1.5% in China, from 2.4% to 1.8% in India, and from 3.7% to 1.4% in Russia. Some countries and regions, such as Brazil and Southeast Asia, showed somewhat different patterns, but the ratio didn't rise notably, even in these cases. The retreat of globalization was a worldwide phenomenon not confined to specific countries or regions.

What made globalization retreat like this? It is because the contradiction inherent in globalization itself has created strong powers for inverse-globalization, such as reshoring, protectionism, and supremacy confrontation.

In the early period of globalization, the reason capitalists in the developed countries moved production bases en masse to emerging countries was, first of all, remarkably low wages in emerging countries. However, the wage gap between developed and emerging countries reduced as time passed. It is because wages in emerging countries rapidly rose as unity and wage struggle of workers grew with industrialization proceeding. In particular, large-scale wage struggles in 2010 in China, which became the 'factory of the world,' were an important turning point. In addition, in developed countries, wages of new workforces in manufacturing industries considerably declined as the two-tier wage system spread on top of overall wage stagnation.

The reduction of the wage gap between developed and emerging countries began to invoke doubts about the long-term benefits of production base movement to emerging countries when considering logistics costs etc. Roughly, with 2010 as the split point, many corporations in developed countries began to delay additional productive investment toward emerging countries and even take reshoring, which retrieves production bases in emerging countries back to developed countries. For example, in the US, in 2010-16, before the Trump administration, 438,000 jobs were already announced due to reshoring.

Unlike that reshoring was a relatively quiet economic phenomenon, the rises of protectionism and supremacy confrontation were powerful political phenomenons shaking world order. Neoliberalism, globalization, and financialization reintegrated, in effect, the world into a single order by encompassing the collapse of the USSR and Eastern European and the transition to a market economy in China. And in reverse, such a single world order was a political basis for making it possible for neoliberalism, globalization, and financialization to continue smoothly. In particular, when the 2008 financial crisis broke out, the fact that governments worldwide cooperated closely with each other based on a single world order had a decisive role in preventing the financial crisis from going ahead to a great explosive depression and making it mitigated to the extent of the Great Recession. But globalization brought about protectionism and supremacy confrontation that shakes such a single world order from the bottom.

In April 2009, when the second summit of G20 was held in London, leaders worldwide made an official resolution of the 'block of protectionism' for the joint response to the financial crisis. It was a commitment not to repeat the 1930s experience that countries worldwide fell into protectionism and largely exacerbated the Great Depression. But, workers and people in the US and Europe, devastated by neoliberalism and globalization and even experienced a more rapid setback in living conditions after the 2008 financial crisis, infused enormous energy into protectionist forces under the condition of the absence of revolutionary forces capable of leading them. Finally, in 2016, as Brexit was passed by a referendum in the UK and Trump was elected as president of the US, protectionism arose at the forefront of world politics and international relations.

Protectionist forces' coming to power further accelerated the reshoring that had already unfolded. As the result of the Trump administration's policy to provide tax cut benefits to companies retrieving their foreign investments, 637,000 jobs were announced by reshoring in 2017-20. (As we saw earlier, even though most of the retrieved money was used in share repurchasing, such an extent of the result was produced.) Protectionist forces' coming to power also functioned as a political force to shake the world order. The 'America First' policy that Trump raised made significant fissures in the relations with not only China but also traditional allies in Europe. The rise to power of protectionism, which hates foreign countries and immigrants, powerfully inspired all kinds of far-right forces worldwide which hate social minorities.

China, which had become the 'factory of the world' through globalization, has leaped to the extent of threatening the US's supremacy as the result of repeatedly rapid growth. The conflict between the US intending not to allow more chasing and China planning to reduce the time of chasing made the supremacy confrontation between them visible more early.

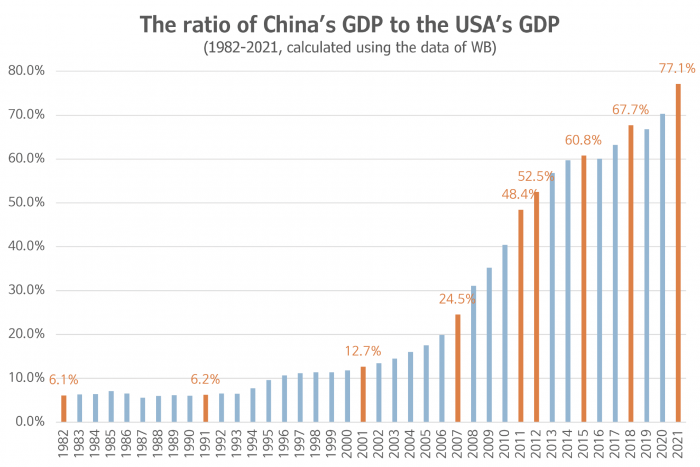

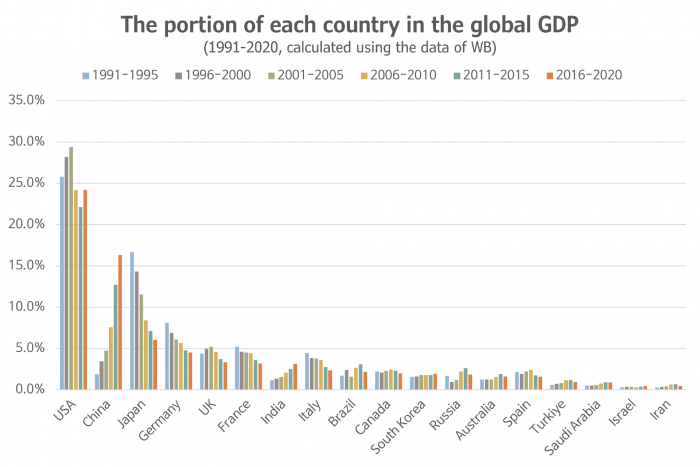

In 1982, when reform and opening-up policy was in the early stage in China, China's GDP compared to the US's GDP was 6.1%. For a long time, this figure modestly increased, reaching only 12.7% in 2001, when China joined WTO. However, after that, in only 6 years, this figure doubled to 24.5% in 2007. And through the 2008 financial crisis, in only 4 years, doubled again to 48.4% in 2011. In addition, China's GDP began to rank second in the world surpassing Japan's in 2010.

China's economic rise has invoked tension and confrontation between the US and China instead of their long honeymoon. In 2011, the Obama administration set the 'Pivot to Asia' as the top foreign policy of the US, which meant containment and siege against China of a 'potential threat.' Against this, China more strongly pulled the rein of chasing. In 2012, when China's GDP recorded 52.5% above half of the US's for the first time, Xi Jinping, who just rose to the General Secretary of the CCP, put forward the 'Chinese Dream' at the forefront, which was, in effect, the dream of China becoming the most powerful country in the world. Furthermore, in 2015, when China's GDP recorded 60.8% of the US's, China announced its 'Made in China 2025' plan, which intended to raise 10 core high-tech industries to the world's highest level by 2025.

In 2018, when China's GDP recorded 67.7% over two-thirds of the US's, the confrontation between the US and China flared up into an all-out trade dispute. In July 2018, the trade dispute between the US and China started, after the first attack by the Trump administration, with giving and taking retaliation tariffs of 25% on imports worth $34 billion. In 2019, the US enforced retaliation tariffs on additional imports worth $300 billion and sanctioned Chinese high-tech companies including Huawei, and against those, China reduced importing agricultural products from the US. Throughout the COVID-19 pandemic, the trade dispute between the US and China has continued.

Through the trade dispute, the US expanded its tariff object range for Chinese imports largely expanded from 1.0% to 66.4%, and raised the average tariff from 3.1% to 19.3%. In 2019, the US could widen the GDP gap with China by using the trade dispute, but as China rapidly recovered its ability to cope, China's GDP reached 77.1% of the US's in 2021. The US's strong containment and China's vigorous chasing tell us that supremacy confrontation between the US and China will more and more inevitably intensify.

Before 2008, globalization functioned as an effective instrument to complement the weakness of neoliberalism and offset the tendency of the rate of profit to fall. However, after 2008, as a result of the unfolding of the contradiction inherent in globalization itself, not only did its original function remarkably mitigate but also it ended up creating political forces of protectionism and supremacy confrontation, which shake the world order and deepen decisively the crisis of capitalism.

(4) Financialization having headed toward a greater financial crisis

Unlike the real economy, which was stuck in stagnation and low growth after the 2008 financial crisis, global stock and real estate markets hotly heated up centered on the US.

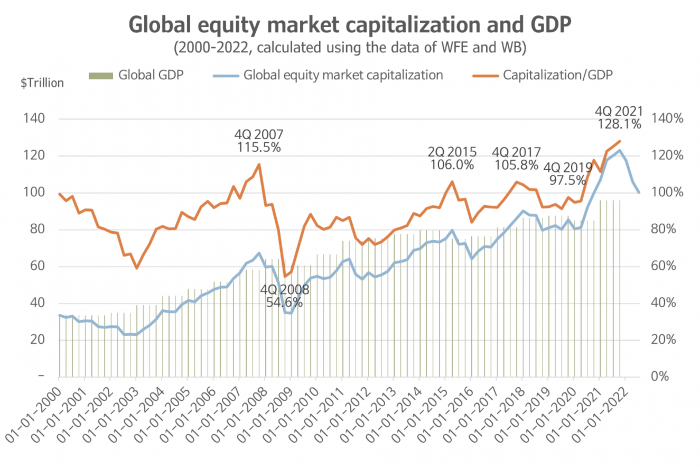

Global equity market capitalization to global GDP, which was 115.5% in the 4th quarter of 2007, dropped to 54.6% in the 4th of 2008 through the financial crisis. But, after that, as a result of repeating tendential rises, it reached 128.1% in the 4th quarter of 2021 as a new peak. The figure at the recent peak was 12.6% points higher than before the financial crisis. It means that a giant bubble bigger than before the financial crisis was formed in global stock markets.

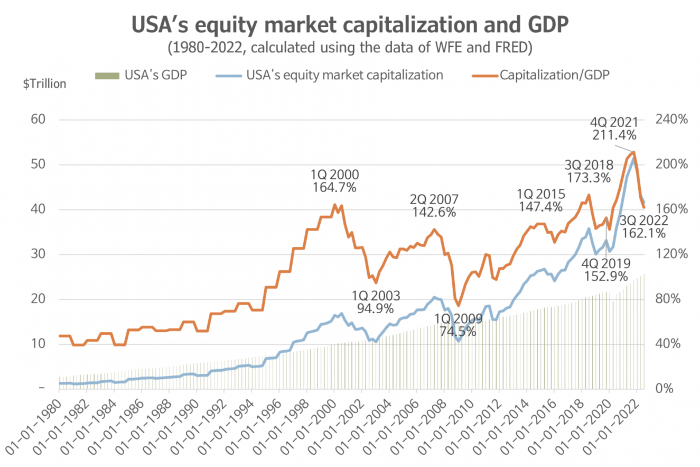

The US stock markets show more dramatic figures. The US's equity market capitalization to GDP, which recorded 164.7% in the 1st quarter of 2000 and 142.6% in the 2nd quarter of 2007, plunged to 94.9% in the 1st quarter of 2003 through the dot-com bubble crash and 74.5% in the 1st quarter of 2009 through the financial crisis. After that, as a result of repeating tendential rises, it reached 211.4% in the 4th quarter of 2021. The figure at the recent peak was even 46.7% points higher than before the dot-com bubble crash, and even 68.8% points higher than before the financial crisis. In the US stock markets, a huge bubble, which is much bigger than before the dot-com bubble crash or the financial crisis, was formed.

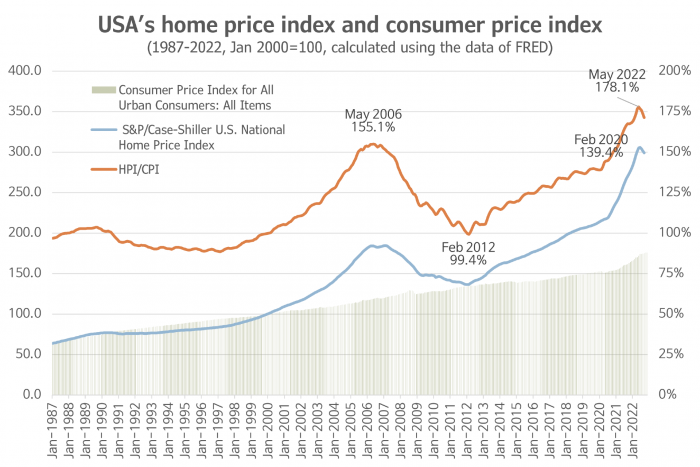

The US real estate market is also serious. The US's (S&P/Case-Shiller) home price index to consumer price index (for all urban consumers), which recorded 155.1% in May 2006, fell to 99.4% in February 2012 through the plunge of real estate prices and the financial crisis. After that, as a result of steady rises, it reached 178.1% in May 2022. The figure at the recent peak was 23.0% points higher than before the financial crisis. Even in the US real estate market, an enormous bubble considerably bigger than before the financial crisis was formed.

In other countries, also severe levels of bubbles were formed. In June 2022, Bloomberg analyzed that real estate bubbles bigger than before the 2008 financial crisis were formed in 19 countries, including South Korea, among all OECD countries, based on the calculation of prices compared to rents and incomes.

Before 2008, financialization was an important instrument for capitalists to reap additional earnings through financial appropriation, on top of super-exploitation by neoliberalism and globalization. However, the 2008 financial crisis proved that financial expropriation is a very dangerous instrument that could push the capitalist system itself to collapse. So it would have been a minimally rational choice for capitalists if they had maintained a distance from financial expropriation, at least for a while after the 2008 financial crisis. Just like they did for more than 60 years after the 1930s Great Depression.

But, as we saw, financial expropriation unfolded at a bigger scale after 2008. And as a result, giant bubbles, much bigger than the 2000 dot-com bubble crash and the 2008 financial crisis, have been formed in global capitalism.

What has made things become like this? To cut a long story short, it is because that capitalism has reached an extent where it can't exist without financial expropriation. Even though enormous neoliberal attacks poured globally to intensify exploitation for a long time, profit rates throughout today's capitalist system have not still escaped from the bottom. Moreover, globalization, which had largely been beneficial in intensifying exploitation, rapidly retreated after 2008. While the driving force of capitalism is the endless hunger for profits by capitalists, it has become impossible to satisfy their hunger for profits without massive financial expropriation properly. Now capitalism has reached a stage where it can't exist, without financial expropriation, in other words, without desperately pushing financial expropriation.

The role of states in inspiring and supporting financial expropriation was decisive in the formation of much bigger bubbles in real estate and stock markets since 2008, which made financial expropriation unfold at a much grander scale. While there were various laws and schemes in different countries, the key was ultra-low interest rates and quantitative easing.

Major central banks, including the US Fed, began implementing ultra-low interest rates and quantitative easing policies right after the 2008 financial crisis to recover real economies, which had been rapidly frozen due to the shock of the financial crisis. They were policies intending to supply sufficient money into the market for capitalists to make productive investments more easily. However, capitalists didn't actively make productive investments due to the bottom-crawling profit rates. After all, over-supplied money contributed more to raising stock and real estate prices. Anyway, for the capitalist class as a whole, that also was not bad. When capitalists couldn't gain sufficient profits through productive investments, it could be an excellent solution to supplement through financial expropriation. As this structure was fixed over time, ultra-low interest rates and quantitative easing were de facto degenerated into instruments to support and raise stock and real estate prices.

However, especially because stock bubbles fiercely ballooned, major central banks had to worry about another financial crisis bursting. As a result, major central banks carefully raised interest rates again and entered quantitative tightening. For example, the US Fed raised the federal interest rate by 2.25% points over nine times from December 2015 to December 2018 and reduced its asset by $700 billion from September 2017 to August 2019. Its ostensible reason was 'normalization due to gradual recovery of the economy,' but preventing the bubble from violent exploding by carefully letting off steam would have been included in the real reason. But the Federal Reserve couldn't let off steam sufficiently because only slight amounts of the interest rate rising and quantitative tightening made the US economy rapidly decline. The Federal Reserve was forced to resume interest rate lowering and quantitative easing in September 2019.

In that situation, as the COVID-19 pandemic broke out, an unprecedented crisis phase unfolded temporarily. For example, the US saw 20 million jobs disappear for only a month in April 2020, which was three times of 6.7 million lost jobs for a year from September 2008 to August 2009 when the 2008 financial crisis broke out. According to IMF, from April 2020 to March 2021, governments worldwide spent $9.9 trillion to cope with the pandemic, and central banks poured $6.1 trillion into the market. This $16.0 trillion injected by governments and central banks worldwide amounted to 18.8% of the global GDP in 2020.

To cope with the economic crisis induced by the pandemic, the US Fed once again maintained its interest rate at zero from March 2020 to March 2022. Also, it carried out a much bigger quantitative easing of $4.8 trillion. At this time, the effects of the policies were similar to the past, but the extent of the effects was much more intensified. Once again, the zero interest rates and tremendous quantitative easing contributed much more to boosting stock and real estate prices than activating productive investment. As a result, giant bubbles of unimaginable levels have been formed in the global stock and real estate markets.

<4> Overturn the epoch of crisis and war into the epoch of revolution!

As we have seen so far, as profit rates in the overall capitalist system couldn't have escaped from the bottom even though repeated neoliberal offensives, as globalization had increasingly retreated, and as financialization had run toward a much bigger financial crisis, the epoch of neoliberalism, globalization, and financialization had been barely continuing. However, in 2022, the war in Ukraine and record-breaking inflation inflicted a strong shock, ending the old epoch and opening the door to a new epoch.

So, what epoch will the new epoch be? Above all, as economic contradictions accumulated in the previous epoch explode, it will be an epoch when capitalist economic crises fiercely erupt. In addition, based on geopolitical contradictions accrued in the last epoch, it will be an epoch when conflicts and wars between imperialist powers become everyday life. Furthermore, as economic crises and wars interlock together to worsen situations continuously, it will be an epoch when the working class and humanity are increasingly immersed in endless miseries. But precisely because of those things, it will be an epoch when class struggles resurrect and develop and when the prospect of a workers' revolution to abolish capitalism emerges as an urgent task and concrete possibility once again, not a vague prospect in the future.

(1) A new world order that the supremacy confrontation and protectionism are making

On what background did the war in Ukraine, which became the turning point for the new epoch, start? And how is it changing the world? To understand these problems, we need to understand the changes in the power relations among countries over the past 30 years.

When we look into changes in the portion of each country in global GDP in 1991-2020, we can get some results similar to what is commonly presumed. The most prominent change is China's sparkling rise and Japan's rapid drop. Also, we can see overall declines in European countries such as Germany, the UK, France, Italy, Spain, etc. The US rose, then largely fell through the 2008 financial crisis, after that, recovering again. We can also find tendential rises in India, Brazil, and Russia.

When we see changes in the portion of each country in global exports of goods and services in 1991-2020, China's remarkable growth is most visible again. Existing developed countries such as the US, Germany, Japan, the UK, France, the Netherlands, Italy, Canada, and Spain have commonly experienced tendential declines. On the other hand, emerging countries such as South Korea, Singapore, India, Mexico, Russia, Brazil, Saudi Arabia, and Turkiye have shown steady growth trends, although not as much as China.

When we see changes in the portion of each country in global Foreign Direct Investment (outflows) in 1991-2020, we can see growths in China, Japan, Germany, Canada, South Korea, and Russia. And we can see drops in the US, France, the UK, and Switzerland. On the other hand, Brazil, Saudi Arabia, India, and Turkiye have continuously trivial levels. In the portion of FDI, we can confirm a greater tendency toward certain countries than exports. Also, we can identify each country has different trends within existing developed countries and do so within emerging countries.

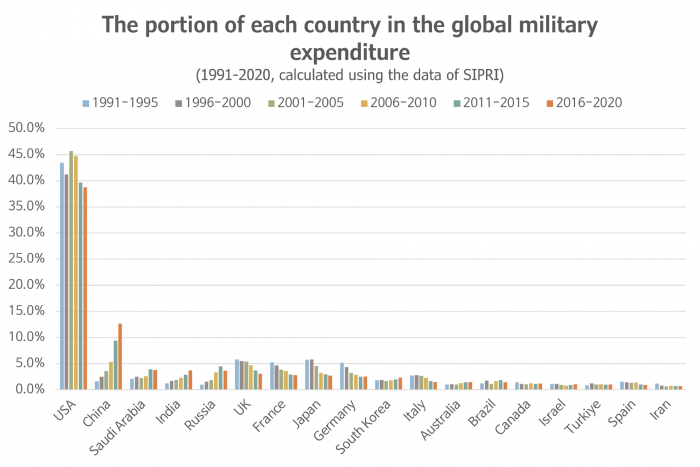

However, when we see changes in the portion of each country in global military expenditure in 1991-2020, we can see considerably different situations from previous parts. Even though the US's decline and China's rise intercrossed, the gap is still pretty big. And Saudi Arabia, India, and Russia, which failed to make their existence prominent in economic indicators, ranked from 3rd to 5th in 2016-2020 after steady growth. On the other hand, the UK, France, Japan, Germany, Italy, and Spain showed steady declines. South Korea, Australia, Brazil, Canada, Israel, Turkiye, and Iran maintained similar levels.

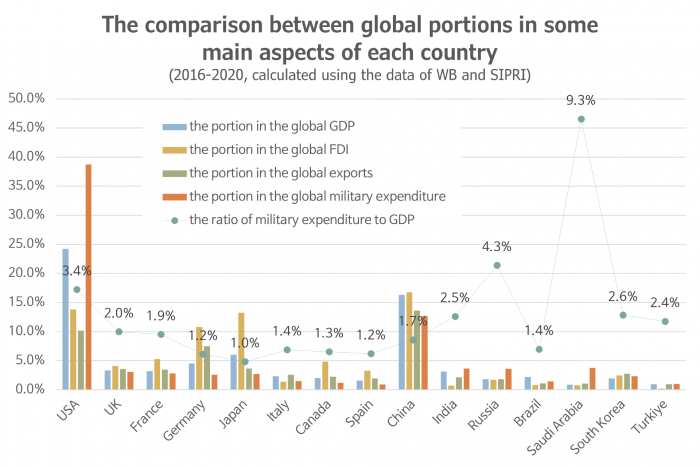

The comparison between global portions in some main aspects of each country in 2016-2020 shows where the power relations among countries, which put together economic and military powers, have reached these days through changes of the past 30 years.

The US still occupies the position of the world's most powerful country but depends more on military power than economic power. China has considerably caught up with the US in economic power and even surpassed especially in exports and FDI, but has not reached the US with the big gap in military power. The difference between the US and China in the interrelation between economic power and military power represents itself also through that the US's military expenditure to GDP is 3.4%, but China's is only 1.7%.

Another prominent point is that India, Russia, and Saudi Arabia maintain relatively strong military power compared to their economic power. (Russia's nuclear weapon power rivals the US, but military expenditure would be a more proper indicator of overall military power.) To maintain such military powers, those three countries spent their military expenditure as 2.5%, 4.3%, and 9.3% of GDP. The figures are considerably or very high, compared to 1.7% of China, which has still focused on economic growth, and 2.6% of South Korea, which has been under constant war risk. Both of economic and military power of Turkiye is not strong, but its military expenditure to GDP recorded at 2.4% as a considerably high one.

On the other hand, existing developed countries except for the US, such as the UK, France, Germany, Japan, Italy, Canada, and Spain, maintain military powers similar to their economic powers or relatively weaker than them. Whereas the UK and France maintain almost the same military power as their economic power by spending around 2.0% of GDP on military expenditure according to the NATO guideline, the rest countries maintain pretty lower military power than their economic power by spending 1.0 to 1.4% of GDP on military expenditure.

Such recent power relations among countries can be summarized as follows. While the supremacy confrontation between the US and China has reached its full-scale stage through China's rapid chasing and the US's containment policies, China is still quite inferior to the US in military power. The supremacy confrontation between the US and China has been and will be giving the possibility of changing power relations among countries by shaking the established order. And, India, Russia, and Saudi Arabia, which have rapidly strengthened their military powers to grab such possibility, are pursuing to enlarge their influence by utilizing the empty space of China's remarkable inferiority in military power to the US.

This can explain, to a large extent, the background for the breakout of the war in Ukraine and subsequent developments. The reason that Russia invaded Ukraine would have been not only because of Russia's fear of NATO's further enlargement to the east, but also Russia's strategic calculation that it would be an important opportunity to enlarge its influence if it successfully occupied Ukraine against NATO. India, which has been participating in the Quad aiming at surrounding China under the initiative of the US, is de facto supporting Russia in this war in Ukraine by refusing to participate in sanctions against Russia and increasing energy imports from Russia. Saudi Arabia, which was a staunch ally of the US, is joining hands with Russia to maintain the crude oil prices high refusing Biden's call for reducing the prices. Also, it is offering its hands to China by allowing Huawei, a target of the US's sanction, to participate in the construction of the futuristic city Neom in the middle of a vast desert.

So, when looking at the overall situation, the war in Ukraine can be said as a process where Russia, India, and Saudi Arabia, which became to maintain stronger military powers than their economic powers are further shaking the world order to grab the possibility to enlarge their influence as the existing world order based on the US's overwhelming supremacy begins to falter due to supremacy confrontation between the US and China.

Of course, when looking at the other parts, the war in Ukraine is also a process where the US, intending to maintain its existing supremacy, is counter-offending by actively supporting Ukraine's proxy war as leading NATO. It is also a process to make Western powers, which are greatly stimulated by the trials to reorganize the world order by some countries including Russia, take up assertive rearmament. In particular, Japan and Germany are commonly pursuing to expand their military expenditure to the level of 2% of GDP.

China is reciprocating carefully but clearly to the three countries that are shaking the world order. While avoiding direct support to Russia in relation to the war, China is de facto supporting Russia by not participating in the sanctions against it and increasing energy imports from it. China is seeking to resolve border disputes with India quickly, saying "we should not miss this crucial change in the international relations that couldn't be seen over a century." And China is trying to make a fissure in the only-in-dollar crude oil trade system, which has been one of the crucial axes for maintaining the US dollar as the key currency, by suggesting payment in yuan in crude oil trade as a reward for a stable large amount of import of oil and gas.

So, will the world order be reorganized into a structure of confrontation between the US-led camp and China-led camp around the supremacy confrontation between the US and China? There is a possibility of that, but another possibility seems bigger at this time. Now, the supremacy confrontation between the US and China will inevitably have continued until the winner is finally confirmed. But it is another problem whether other major powers also will be included as sub-partners within the structure of supremacy confrontation between the US-led and China-led camps.

Above all, the possibility for Russia, India, and Saudi Arabia to become sub-partners or firm allies of China still looks not so high. The strategic interests of those three countries are only in expanding their influence by utilizing empty space opened by the supremacy confrontation between the US and China. While they are improving relations with China according to their needs at this time, they will be likely to change their directions again in the not-so-distant future to meet their other needs. In other aspects, China is not yet strong enough to encompass those three countries under its leadership.

A more important reason is that the contradiction within the US-led Western camp is by no means trivial. Biden's foreign policy to revive the US's relations with traditional allies against Trump's America First policy seems to have become successful by recovering the unity of NATO through the joint response to the war in Ukraine. However, in August 2022, the Biden administration and Democratic Party implemented their America First policy, which is beyond Trump's one, by enacting the 'CHIPs and Science Act' and the 'Inflation Reduction Act.' Under the 'CHIPs and Science Act', only companies producing semiconductors in the US and abandoning investments in China for 10 years will be able to receive subsidies from the US government. And under the 'Inflation Reduction Act', only companies moving production bases for electrical cars and batteries to North America will be able to receive subsidies from the US government. Furthermore, even though the US energy companies earn ridiculously huge profits by exporting gas to Europe substituting Russia, the Biden administration doesn't take any action about that. Understandably, European countries, around France and Germany, are angry at such actions of the US striking blatantly the backs of allies' heads. So, European countries are hurrying to pursue their protectionism policy, including the European Chips Act, the Carbon Border Tax Act, the Critical Raw Material Act, etc.

The US's political situation where protectionism is already prevailing and its economic situation which would increasingly deteriorate tell us that the US would strengthen protectionism regardless of parties. If so, European countries would inevitably counterattack with their protectionism, and the US-led Western camp would inevitably lead to severe cracks. And then, at a certain point, the US would lose its power to bind European powers continuously under its leadership, especially if the supremacy confrontation between the US and China is not concluded with the US's unilateral win.

Therefore, afterward, it seems that the world order will likely have features that, on the one hand, the US and China engage in supremacy confrontation, but on the other hand, various powers pursue their independent directions based on protectionism and so make the structure of imperialist multipole confrontation. Russia, India, and Saudi Arabia are already pursuing the reorganization of the world order assertively. On top of that, in major European countries such as France or Germany, if protectionism fiercely expands or far-right forces come to power, those countries will likely reposition themselves as hegemons leading the surrounding region and escaping US supremacy. Turkiye, which doesn't hide its ambition to be a regional hegemon even though it doesn't have strong economic and military power yet, also could be a dark horse. Whereas, in Northeast Asia, including the Korean Peninsula, all countries will likely be under the structure of the supremacy confrontation between the US and China because of its strong impact due to geopolitical conditions.

A new world order, where the US-China supremacy confrontation and imperialist multipole confrontation coexist, would be considerably different from the single world order of the sole US supremacy, which made neoliberalism, globalization, and financialization possible. Even if a new world order converges simply to the US-China supremacy confrontation, it also would be pretty different from the single world order. Anyway, the new epoch will be a period of turbulence in which conflicts and wars between imperialist powers become everyday life and are increasingly intensified.

(2) Hyperinflation or great financial depression and massive imperialist war

What would have happened if, during the 2008 financial crisis and the 2020 COVID-19 pandemic crisis, enormous fiscal spending of governments worldwide and ultra-low interest rates and quantitative easing policies of central banks didn't implement? The results are almost obvious. The world economy would have entered into a great explosive depression (not inferior to the 1930s Great Depression) full of tremendous bankruptcies and unemployment.

Meanwhile, for a year after the break-out of the 2008 financial crisis and for a year after the break-out of the 2020 COVID-19 pandemic crisis, the average percentage change in the US consumer price index from a year ago respectively recorded -0.3% and 1.2%. If these figures had been over 7% or even around 10%, would such policies of governments and central banks worldwide have been possible? Or could they have had effects similar to what we experienced? It's not a simple question. Anyway, in such situations, enormous fiscal spending, ultra-low interest rates, and quantitative easing would have been by no means easy. It is because such policies could have provided huge energy to inflation. But doing nothing also would have been impossible, because the world economy could have slipped into a great depression unless doing something. So, the capitalist class worldwide would have had to find a miraculous balance point, not providing huge energy to inflation but capable of blocking a great depression. Only if such a balance point had existed.

What will happen if such situations repeat several times in increasingly worsened forms? They would be able to find such a miraculous balance point once or twice, but will it be continuously possible? What will happen if it is impossible? Hyperinflation? Great financial depression? Or both of them?

The problem is the possibility that such situations will be laid in front of us is very high. The possibility comes from two points. First, (as explained earlier) even though a tremendous financial crisis is already possible at any time due to unprecedented bubbles in the global stock and real estate markets, today's capitalism will inevitably form more enormous bubbles continuously because it has to pursue huge financial expropriation endlessly. Second, the new world order dominated by supremacy confrontation and protectionism substituting globalization will inevitably make the wave of inflation strike the world repeatedly.

Under the new world order, conflicts between imperialist powers, which will occur much more frequently due to supremacy confrontation and protectionism, will repeatedly put the global supply chain into chaos, if not necessarily leading to war. And such conflicts will force the global supply chain itself to be reorganized by the logic of supremacy confrontation and protectionism than the logic of the economy. That will mean considerable additional costs and inefficiencies economically.

In fact, the logic of the new world order to put ahead the supremacy confrontation and protectionism than globalization is already working. In 2022, despite suffering from significant inflation, the US has not revoked high tariffs on imports from China. Also, the US intends to exclude China from the high-tech semiconductor supply chain as a part of the supremacy confrontation and give massive subsidies only to companies to produce in the US as putting ahead protectionism. The logic of globalization, which is 'to produce at the cheapest place,' is assertively being denied by the US, which once forced globalization on the whole world with its power. Instead of long-term low prices that were possible by producing at the cheapest place, now a period to live with inflation will inevitably unfold as a long-term trend.

In 2022, major central banks, including the US Fed, have quickly raised interest rates to cope with inflation. For example, the US Fed has raised 4.25% points of the federal interest rate over seven times from March to December. As a result, the US inflation rate gradually declined from 9.1% in June to 6.5% in December. But the Consumer Price Index is still high, and the US Fed is forecasted to raise about 1% points of the federal interest rate additionally in 2023. Anyway, through that, this wave of inflation would be able to be repressed. But, from now on, the wave of economic stagnation induced by interest rate raising, through the rings of debt burden increasing, corporate credit crunch, household consumption shrink, and stock and real estate prices decline should be passed through.

It isn't yet evident what extent coming economic stagnation will be. However, considering the 2008 financial crisis broke out two years after the US Fed had raised 4.25% points of the federal interest rate in 2004-2006, the wave height of this interest rate raising, which will raise more during less period, could be not-so-small. In fact, the US's equity market capitalization to GDP recorded 162.1% in the 3rd quarter of 2022, which was 49.3% points lower than 211.4% at its peak in the 4th quarter of 2021. (In the dot-com bubble crash, the figure dropped by 69.8% points for 12 quarters, and in the financial crisis, 68.1% points for 7 quarters.) While the US real estate market, which formed a huge bubble equivalent to the stock market, is yet in a slight decline after reaching its peak in May 2022, the extent and speed of decline in that market also will largely affect the economic situation in the world, beyond the US. Meanwhile, according to the IMF, total global debts, encompassing household, corporate, and public debt, rose from 195% in 2007 to 256% in 2020. The fact that the burden and impact due to interest rate raising become more significant as much as debt increase could be an important factor in worsening coming economic stagnation.

But, looking at the other aspects, we can confirm some parts prepared better than the 2008 financial crisis. For example, the US has made the interest rates of almost all mortgage loans fixed after the 2008 financial crisis, which will be effective to some extent in mitigating the burden due to interest rate raising (at least in the US). Some analysts argue that the number of countries immersed in a foreign exchange crisis has been yet relatively small, different from the past cases, compared to the extent and speed of the interest rate raising of the US Fed because many countries have prepared based on past experiences. So there are some forecasts, mixed with hopes, that economic stagnation in 2023 will be relatively less serious. Whereas, there is another forecast that Japan and China will provoke a global economic crisis. Japan is maintaining its standard interest rate of minus due to its world's top-level state debt of 266% of GDP, even though inflation is reaching its highest point over 40 years. And China is already experiencing a huge real estate bubble bursting.

No matter how severe the economic stagnation in 2023 is, the real problem could be the next. It is because, due to huge accumulated state debts already reaching 100% of GDP on the average in the world, and due to the flame of inflation not easily extinguished, it will be challenging for governments and central banks to implement economic boosts through enormous fiscal spending, ultra-low interest rates, and quantitative easing. We could assume a scenario that economic stagnation begins not-so-seriously in 2023 but, as governments and central banks show their incapabilities for economic boosts, it increasingly worsens with prolonged extension and then finally enters into a severe economic crisis. Or we could assume another scenario that, as governments and central banks implement economic boosts beyond their capabilities, more huge bubbles are formed once again, and then much more rapid and strong inflation swoops the bubbles.

Anyway, it is impossible to anticipate the future concretely. The aspect and speed with which the situation unfolds will be changed by many variables that we can't know now. But, we can foresee the trend at least. That is, it is highly likely that the global economy will go ahead, by going through some twists and turns, toward either hyperinflation or a great financial depression, or even both of them.

What choice will the capitalist class make when capitalism reaches such a catastrophic situation? When reaching such a situation, the most reliable exit for the capitalist class would be the historical experience of Word War II, which made capitalism escape from the 1930s Great Depression and recover vigor to some extent by carrying out mass destruction and genocide. As such a long total war would not be easy nowadays due to abominable nuclear armaments that could destroy the earth itself, the capitalist class would pursue other forms of massive wars having similar effects. Conflicts between imperialist powers, with supremacy confrontation and protectionism putting ahead, that would be accumulated during the capitalist economy is heading to a catastrophe, would provide the capitalist class sufficient opportunities and causes capable of being used for such wars. To desperately make such extremely reactionary wars possible, the resistance of the working class must be repressed thoroughly, so the capitalist class would try to establish fascist regimes in many countries.

(3) For the reconstruction of class struggle and revolutionary development

Neoliberalism, globalization, and financialization, which swept away the world after the 1980s, unfolded on the basis of having calmed workers' explosive struggles worldwide in the 1970s. Therefore, before the 2008 financial crisis, workers' struggles worldwide were in stagnation more severe than ever before, even though exploitation and expropriation were considerably strengthened. (From a global perspective, South Korea's experience of going through a period of powerful workers' struggles from the late 1980s to the early 1990s was one of the exceptional cases, together with Brazil and South Africa.)

However, the 2008 financial crisis made the aspect of workers' struggles also considerably change. It is because the capitalist class worldwide inflicted tremendous offensives continuously to make the working class burden the sufferings and costs due to the financial crisis. Under the wave of the financial crisis, numerous workers and people became intensive victims of financial expropriation, being robbed of their houses or going bankrupt. Many governments, which spent astronomical finance through bail-outs and economic boosts to cope with the financial crisis, poured massive offensives, such as layoffs and wage cuts in public sectors, welfare spending cuts, pension reform, etc., to pass on the burden of exploding increase in state debts to workers. Private corporations worldwide also unfolded large-scale restructuring to shift the burden of credit crunch and consumption shrinking due to the financial crisis to workers. And across the period of the Great Recession, labor law reforms continued one after another aiming at the retreat of workers' rights and weakening of labor unions. Flexibilization of labor, which has expanded since the 1980s, more accelerated, making many more workers become into more various forms of unstable workers.